Why combat money laundering and terrorism financing?

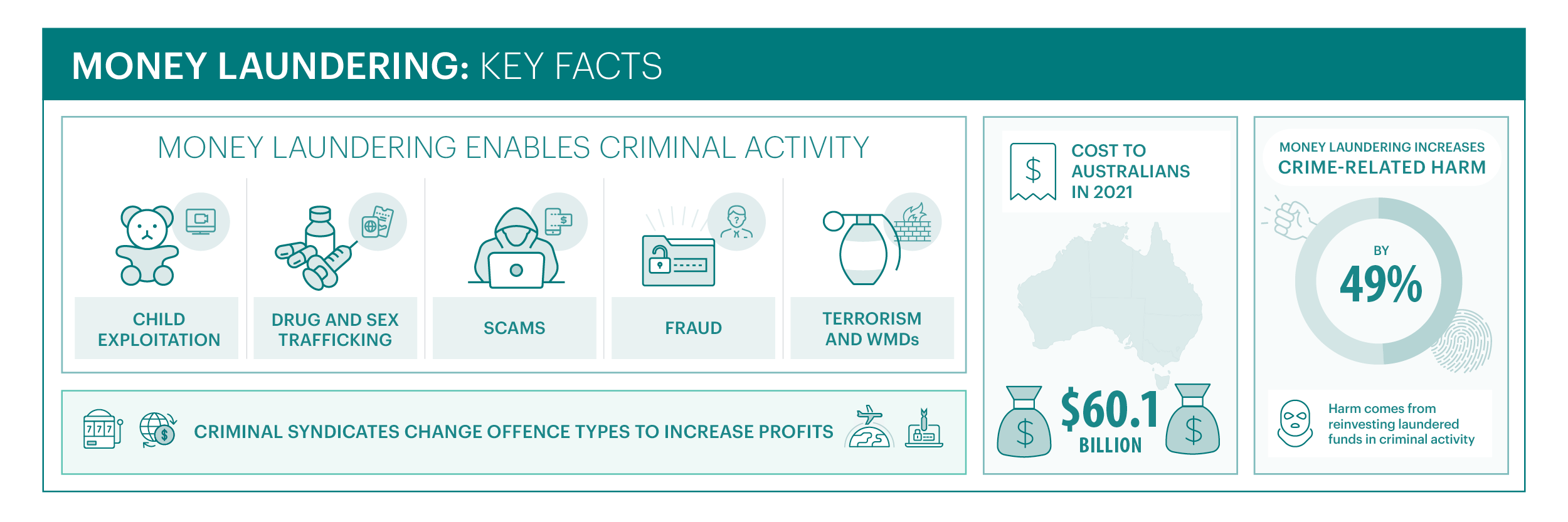

Money laundering is a key enabler of serious crimes such as child exploitation, drug and sex trafficking, scams, fraud, terrorism and the proliferation of weapons of mass destruction.

Serious and organised criminal groups are driven by illicit profit. It sits at the centre of why they conduct their illegal activities.

Terrorism financing also plays a vital role in enabling terrorist activity, with even small-scale and low-value financing being capable of providing the means to launch terrorist attacks, sow community discord and erode trust in government and democratic norms.

The anti-money laundering and counter-terrorism financing (AML/CTF) regime also includes combating proliferation financing. Proliferation financing enables the spread of weapons of mass destruction, potentially violating international agreements and leading to a world that is less safe.

On this page

- Money laundering and terrorism financing causes harm

- Businesses are on the front line

- How the AML/CTF regime helps combat these threats

- Infographic: Money laundering key facts

- Related pages

Money laundering, terrorism financing and proliferation financing cause harm

Recent research by the Australian Institute of Criminology estimated that serious and organised crime cost Australia up to $60.1 billion. This research also highlights the significant harm it is causing to the Australian community.

Money laundering by organised crime groups increases their profits and the amount of crime-related harm to the community. Their activities are not only a direct threat to the community, but also have security, economic and social impacts on Australians.

Criminals exploit the businesses to disguise illicit funds and enable serious crimes. Every day, criminals around the world generate billions of dollars in profits from transnational, serious and organised crime.

Terrorism financing is often linked to the terrorist act itself, including the purchase of weapons, vehicles, explosives and other activity to prepare for a terrorist act, for foreign fighters to travel to conflict zones or to generally support domestic and foreign terrorist groups.

No legitimate business wants to assist criminals to launder the profits of their crimes or fund terrorism. Through regulation, businesses are asked to play a vital role in detecting and preventing the misuse of their sectors and products by criminals.

Businesses are on the front line

The businesses we regulate are at the front line of combating money laundering, terrorism financing and the crimes they enable.

Money laundering is the process used to place, layer and integrate these funds into the legitimate financial system and obscure their illicit origins.

AUSTRAC’s Money Laundering in Australia National Risk Assessment 2024 (ML NRA) identified that businesses are regularly exploited by money laundering networks. These networks use business’ services to disguise the criminal origins of their funds and reinvest them in further criminal activity.

The ML NRA identified persistent exploitation of:

- channels historically used to launder funds, including banks, remitters and casinos

- high-value assets such as luxury watches, precious stones and real estate

- services provided by professional service providers to help establish complex business structures and associated banking arrangements that criminals use to launder and conceal proceeds of crime.

The ML NRA also found that:

- domestic real estate generated a very high risk of money laundering, while real estate agents posed a medium risk, noting that the real estate sector is a widely exploited asset type for money laundering in Australia

- luxury goods such as jewellery pose a high risk of money laundering, as they are an effective and low-cost channel to store and transfer criminal proceeds

- lawyers and accountants, along with companies and legal structures, pose a high risk of money laundering, as they can facilitate money laundering by obfuscating the source of illicit funds and beneficial ownership

- cash continues to pose a very high risk of money laundering, remaining a mainstay of money laundering in Australia and abroad.

AUSTRAC’s Terrorism Financing in Australia National Risk Assessment 2024 (TF NRA) also identified that terrorists and their financiers largely continue to employ the same established methods for raising and moving funds.

- Financiers prefer readily available and proven methods to move funds, such as banking, remittance and exchange of cash, over complex schemes.

- Non-bank online payment service providers play an increasingly important role in the terrorism financing payment chain as they facilitate many payments for platforms in the ‘online funding ecosystem’.

- There has been an increase in the use of digital currencies.

How the AML/CTF regime helps combat these threats

The AML/CTF regime helps to combat these threats in two ways.

First, by supporting businesses to harden themselves against criminal threats. This includes understanding their risks and taking appropriate action. This reduces opportunities for money laundering, terrorism financing and proliferation financing.

Second, by businesses reporting valuable information and suspicious activity to AUSTRAC. This provides law enforcement and national security agencies with financial intelligence to detect, investigate and prosecute criminal activity, as well as restrain and confiscate the proceeds of crime.

Infographic: Money laundering key facts

The content on this website is general and is not legal advice. Before you make a decision or take a particular action based on the content on this website, you should check its accuracy, completeness, currency and relevance for your purposes. You may wish to seek independent professional advice.