AML/CTF Reform

The Anti-Money Laundering and Counter-Terrorism Financing Act (AML/CTF Act) is changing.

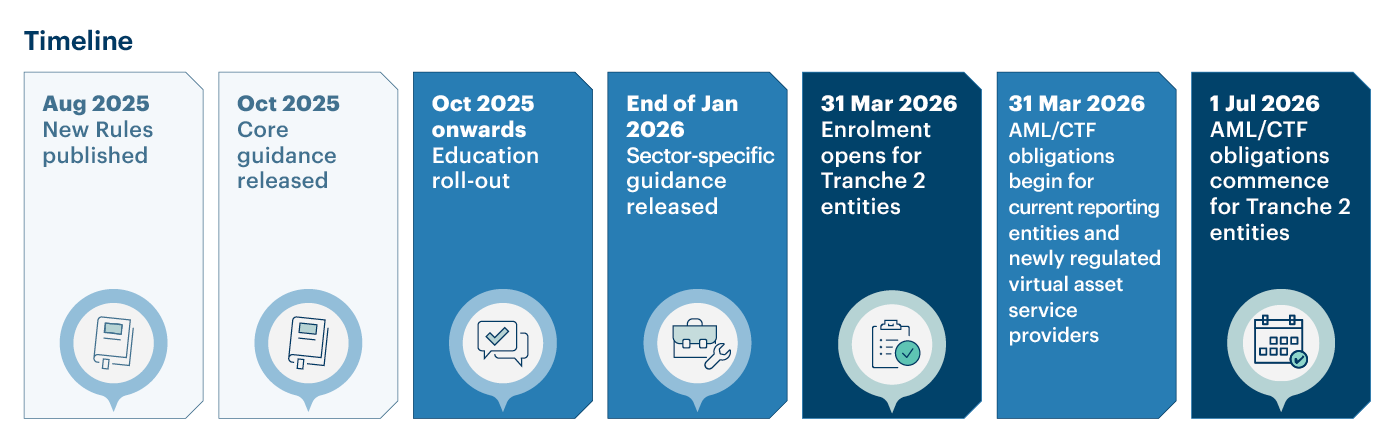

From 1 July 2026 new services and entities, known as tranche 2, will come under our regulation. The reformed laws also impact current reporting entities. On this page you’ll find information about:

- how to find out if you’ll be regulated

- key milestones

- what you can do to prepare.

You can learn more about the reforms and how they affect you.

Newly regulated businesses (tranche 2)

Subscribe for updates

Want to stay up-to-date on AML/CTF reform? Subscribe for updates on consultations, guidance, education and events.

Further assistance

We are working with industry associations to develop guidance tailored to your industry. In the meantime, if you have questions about how the reforms impact you, your industry association may be able to assist.

This guidance sets out how we interpret the Act, along with associated Rules and regulations. Australian courts are ultimately responsible for interpreting these laws and determining if any provisions of these laws are contravened.

The examples and scenarios in this guidance are meant to help explain our interpretation of these laws. They’re not exhaustive or meant to cover every possible scenario.

This guidance provides general information and isn't a substitute for legal advice. This guidance avoids legal language wherever possible and it might include generalisations about the application of the law. Some provisions of the law referred to have exceptions or important qualifications. In most cases your particular circumstances must be taken into account when determining how the law applies to you.