Combating money laundering, terrorism financing and proliferation financing

Discover why we’re on the front lines to stop money laundering, terrorism financing (ML/TF) and proliferation financing and how we fight organised and serious crime.

On this page

- Money laundering

- Terrorism financing

- Proliferation financing

- Money laundering, terrorism financing and proliferation financing cause harm

- Your business is on the frontline

- How the anti-money laundering and counter-terrorism funding regime helps

- Related pages

Money laundering

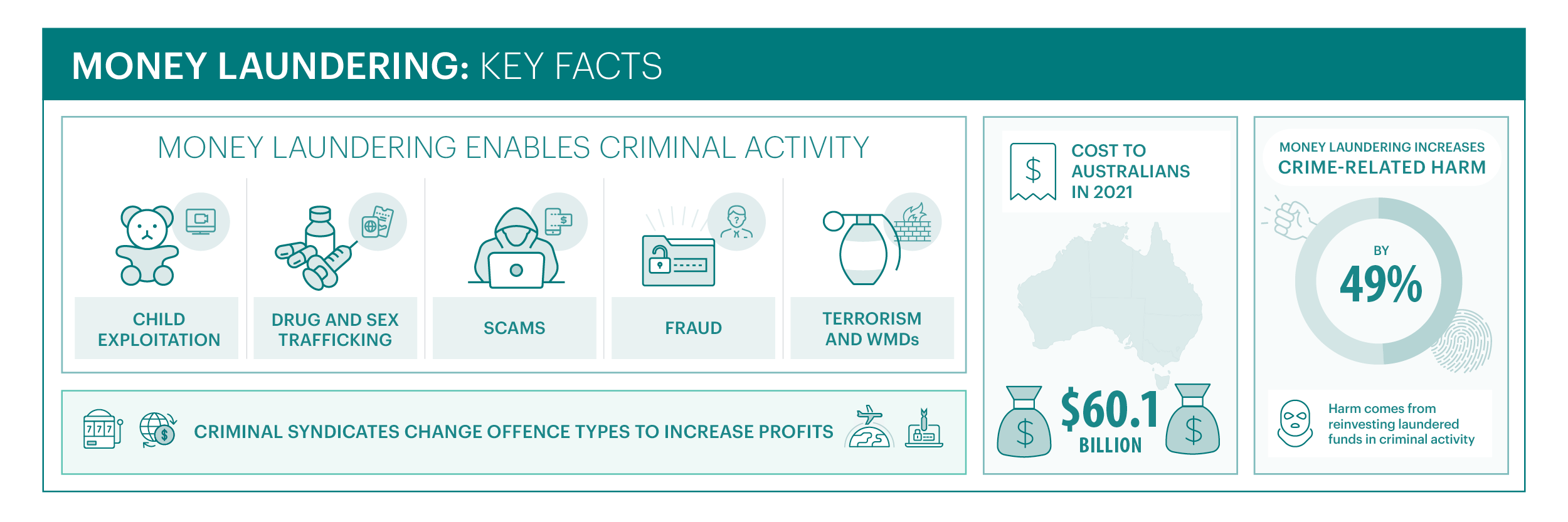

Money laundering is an enabler of serious crimes such as:

- child exploitation

- drug and sex trafficking

- scams

- fraud

- terrorism

- proliferation of weapons of mass destruction (WMD).

Serious and organised criminal groups are driven by illicit profit. It sits at the core of why they commit crimes.

Read our definition of money laundering.

Terrorism financing

Terrorism financing funds terrorist activity. Even small-scale and low-value financial help provide the means to:

- launch terrorist attacks

- create community unrest

- erode trust in government and democratic norms.

Read our definition of terrorism financing.

Proliferation financing

Proliferation financing is funding or providing services and transactions that facilitate the development of WMDs. WMDs include:

- nuclear

- chemical

- biological.

Proliferation financing diverts funds from our legitimate economy and can impact the reputation of our economy and financial system.

Read our definition of proliferation financing.

Money laundering, terrorism financing and proliferation financing cause harm

Research by the Australian Institute of Criminology estimated that serious and organised crime cost Australia up to $60.1 billion between 2020 and 2021. This research also highlights the wider harm it causes to the Australian community.

Money laundering by organised crime groups increases their profits and the amount of crime-related harm to the community. Their activities are a direct threat to the community and have security, economic and social impacts on all Australians.

Terrorism financing is often linked to the terrorist act itself. This includes:

- buying weapons, vehicles and explosives

- other activity to prepare for a terrorist act

- foreign fighters travelling to conflict zones

- supporting domestic and foreign terrorist groups.

Your business is on the frontline

As a business we regulate, you’re on the front line helping us to combat ML/TF and proliferation financing.

Money laundering risk assessment

Our money laundering in Australia national risk assessment 2024 (ML NRA) identified that businesses are regularly exploited by money laundering networks. These networks use business’ services to disguise the criminal origins of their funds and reinvest them in more criminal activity.

The ML NRA also identified persistent exploitation of:

- channels historically used to launder funds, including banks, remitters and casinos

- high-value assets such as luxury watches, precious stones and real estate

- services provided by professional service providers to help establish complex business structures and banking arrangements. These are then used by criminals to launder and conceal proceeds of crime.

The ML NRA also found that:

- domestic real estate generated a very high risk of money laundering, while real estate agents posed a medium risk. The real estate sector is a widely exploited asset type for money laundering in Australia

- luxury goods such as jewellery pose a high risk of money laundering, as they’re an effective and low-cost channel to store and transfer criminal proceeds

- lawyers and accountants, along with companies and legal structures, pose a high risk of money laundering. They can facilitate money laundering by hiding the source of illicit funds and beneficial ownership

- cash poses a very high risk of money laundering. It remains a cornerstone of money laundering in Australia and overseas.

Terrorism financing risk assessment

Our terrorism financing in Australia national risk assessment 2024 (TF NRA) identified that terrorists and their financiers continue to use the same methods for raising and moving funds.

- Financiers prefer readily available and proven methods to move funds, such as banking, remittance and exchange of cash, over complex schemes.

- Non-bank online payment service providers play an increasingly important role in the terrorism financing payment chain as they facilitate many payments for platforms in the ‘online funding ecosystem’.

- There’s been an increase in the use of digital currencies.

Proliferation financing risk assessment

Our proliferation financing in Australia national risk assessment 2022 identified the threats to Australia include the:

- use of Australian financial services and infrastructure to procure dual-use goods and evade sanctions

- use of Australia-based corporate structures to facilitate proliferation financing and evade sanctions

- use of Australian or third-country nationals to facilitate proliferation financing and evade sanctions

- exploitation of Australian citizens to source and export sensitive technologies and knowledge for use by actors of proliferation concern

- use of designated non-financial businesses and professions to facilitate proliferation financing and evade sanctions.

How the anti-money laundering and counter-terrorism funding regime helps

The anti-money laundering and counter-terrorism financing (AML/CTF) regime helps to combat ML/TF threats in 2 ways.

First, it supports businesses to educate themselves about criminal threats. This includes understanding their risks and taking action. This reduces opportunities for ML/TF and proliferation financing.

Second, by businesses reporting valuable information and suspicious activity to us. This helps us, law enforcement and national security agencies detect, investigate and prosecute criminal activity. It also helps to confiscate the proceeds of crime.

Subscribe for updates

Want to stay up-to-date on AML/CTF reform? Subscribe for updates on consultations, guidance, education and events.

This guidance sets out how we interpret the Act, along with associated Rules and regulations. Australian courts are ultimately responsible for interpreting these laws and determining if any provisions of these laws are contravened.

The examples and scenarios in this guidance are meant to help explain our interpretation of these laws. They’re not exhaustive or meant to cover every possible scenario.

This guidance provides general information and isn't a substitute for legal advice. This guidance avoids legal language wherever possible and it might include generalisations about the application of the law. Some provisions of the law referred to have exceptions or important qualifications. In most cases your particular circumstances must be taken into account when determining how the law applies to you.